View or change your details

Help with your product

Help with your card

Banking near me

What are the different balances in Anytime Internet Banking?

Recently we’ve changed the way we display your accounts and balances in Anytime Internet Banking to give you a clearer view of your money.

How do I register for Anytime Internet Banking if I don't have a debit card?

If you do not have a debit card, you can simply leave this field blank and carry on with your application.

Why do I get a message that my customer number entered has been disabled?

To protect you and your accounts, we constantly monitor our Anytime Internet Banking and mobile app services and it may have been necessary for us to temporarily disable your service.

What is a card-reader and how do I use one?

A card reader gives you an extra level of security when using Anytime Internet Banking, and you may need to use it to confirm your identity when logging in if you don’t have a mobile number, or you’ve recently updated it with us.

I haven't received my Anytime Internet Banking activation code, what can I do?

You'll need an Anytime Internet Banking activation code when you register, re-register or open an account with us. We'll send you your code by text message within a few minutes if you have a UK mobile number.

It says 'service temporarily unavailable', what should I do?

We do carry out essential maintenance between 1.55am and 2.30am (UK time) every day to keep our systems up to date. During these times Anytime Internet Banking will be unavailable.

What is my Anytime Internet Banking Mailbox and how do I access it?

Your Anytime Internet Banking mailbox or mobile app enables you to securely receive and access important mail we've sent you in electronic format. You can view, download, share, archive or print PDF copies of your mail at your convenience.

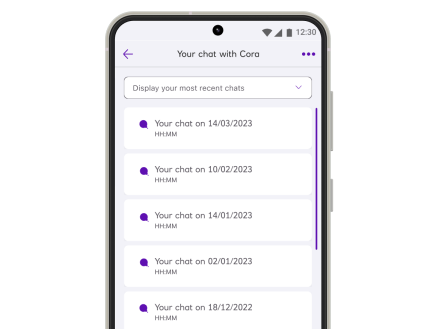

Cora is here to help you

Available 24/7

Cora can support you ith a wide range of queries. If Cora can't help you, she'll pass you on to one of our colleagues who can assist you.

Helps you change your details

Cora can update your address and help you get your phone number, email address or name updated too.

Allows you to report a lost card

Cancel your lost card and securily order a new one.

Helps you get a PIN reminder

Forgotten your PIN? Get a PIN reminder through Cora.