On this page

What is Open Banking?

Open Banking is an initiative designed to improve and enhance everyone’s banking experience. The core idea of Open Banking is that you can provide banks with secure access to your accounts so that you can manage your finances all in one place.

How does Open Banking work?

When you sign up for Open Banking, you can choose to provide banks and other third parties with secure access to your accounts. The information held in your accounts is then shared securely between organisations using Application Programming Interfaces, or APIs.

You can find out more about Open Banking from our Open Banking FAQs, or by visiting the Open Banking website.

Add accounts from other banks

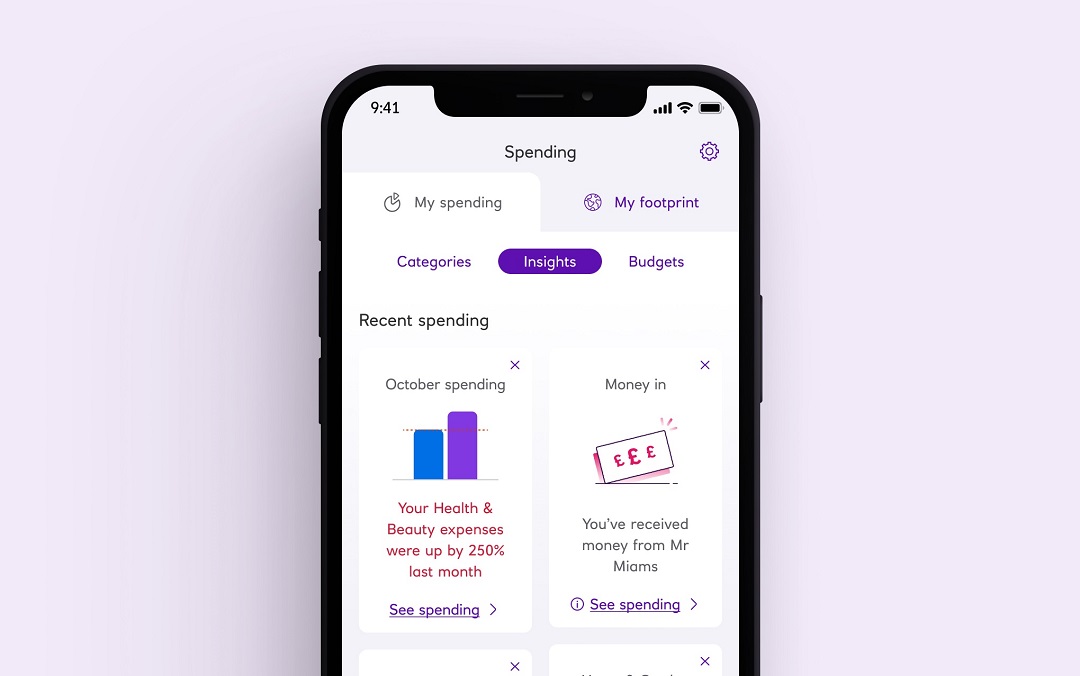

With account aggregation you’ll be able to add accounts from other banks directly to your NatWest app. This will allow you to see your balance and transactions from your other accounts quickly and easily, saving you the hassle of logging into multiple accounts.

View balances and transactions on selected account types held with other participating UK banks using our mobile app. You must be registered for your other banks online banking. App available to personal and business banking customers aged 11+ using compatible iOS and Android devices and a UK or international mobile number in specific countries.

The Ulster Bank app

Manage your day to day banking and stay in control of your money by seeing where you're spending it, create budgets and add accounts with other banks. Criteria applies.