Already using FreeAgent?

What's FreeAgent?

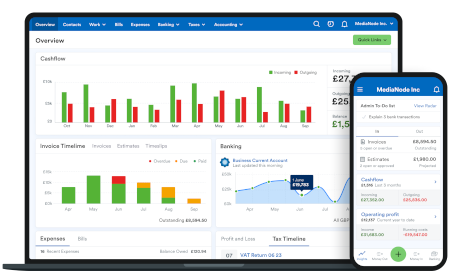

FreeAgent's award-winning online accounting software is designed for accountants, bookkeepers and their small business and landlord clients. Over 150,000 customers use FreeAgent to monitor cashflow, send invoices, record expenses and much more.

Your clients who have an Ulster Bank business current account can access FreeAgent for free, as long as they retain their bank account. When you sign up as a FreeAgent Partner, you’ll get free access to your own Practice Dashboard, which allows you to manage all your clients from one place. Optional add-ons may be chargeable.

*Friendliest Software of the Year, Institute of Certified Bookkeepers Luca Awards 2023.

Business banking is available to eligible customers who are over 18 and have the right to be self-employed in the UK.

Additional benefits for accountants and bookkeepers

When you add your first client to your Practice Dashboard, you’ll gain access to the following benefits:

- Migration support to get you and your clients set up on FreeAgent

- Free training to help you and your team get FreeAgent accredited

- Promotion of your practice on the FreeAgent Accountant Directory

- Help from a dedicated account manager and our specialist practice support team

If you have 10 or more active clients using FreeAgent, you can access further benefits as part of the Partner Programme.

How FreeAgent supports your practice

- Manage your clients at a glance from your Practice Dashboard

- Set individual user access levels for each client

- File Self Assessment and VAT returns directly to HMRC

- Final Accounts and Corporation Tax return filing for limited company micro-entities

- Run bulk payroll and submit RTI directly to HMRC

How FreeAgent supports your clients

- iOS and Android mobile apps to manage business admin on the go

- User-friendly interface with clear summaries of cashflow and profit and loss

- Open Banking bank feeds to securely import clients’ bank transactions

- Multi-currency banking, invoices, bills and expenses

- Live updates of clients’ tax projections and deadlines

- Market-leading integrations with software providers such as Shopify and PayPal

Making Tax Digital (MTD) for VAT

Making Tax Digital (MTD) for VAT requires all VAT-registered businesses to keep digital records and use MTD-compatible software to submit VAT returns. With FreeAgent, you can file MTD VAT returns directly to HMRC and you’ll be ready for MTD for Income Tax Self Assessment when it comes into effect in 2026.

Clients can connect their bank account

Your clients can connect their bank accounts to FreeAgent to automatically and securely import all of their daily bank transactions via an Open Banking bank feed. Track incomings and outgoings, link invoices to payments and view interactive charts.